The Norwegian pension system

Do you think pensions are complicated? You're not alone. Every other Norwegian doesn't know how much they will receive when they retire. Here's a brief introduction to pensions in Norway, and how they are structured.

A pension is what you will live off when you retire - a form of delayed salary, if you will. Through your work and salary you will influence the size of your pension and how large this delayed salary will be once you retire. You should begin thinking about your pension at least from the age of 40.

Here's how pensions are structured

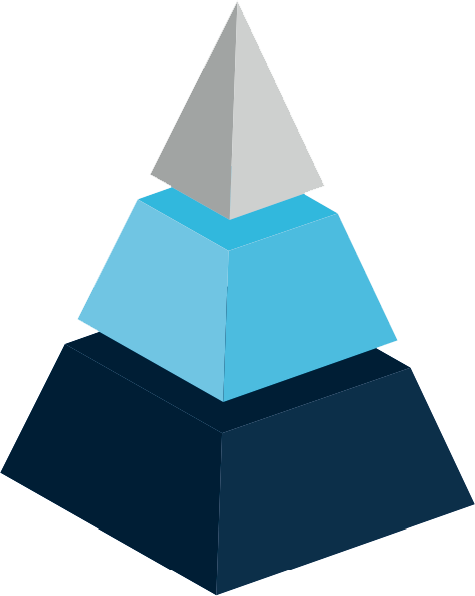

There are many different types of pensions, but simply put, pensions are structured into three levels. The levels are usually of different sizes in value, and therefore we often refer to the structure as a pension pyramid.

The National Insurance Scheme is the foundation

At the bottom of the pyramid we find the National Insurance Scheme (folketrygden). All persons residing/working in Norway are, as a rule, compulsory members of this scheme, administered by Nav. Members are entitled to various benefits including healthcare in Norway, in addition to saving towards a state pension according to the scheme’s regulations. Anyone who has lived in Norway for at least three years after turning 16 is entitled to an old-age pension. How much you'll receive from the National Insurance Scheme primarily depends on how much you have worked.

Occupational pensions are the next level

The second tier in our pension pyramid is the occupational pension, which is money that your employer(s) sets aside for you. From 2022 it became obligatory that all employees in both the private and public sector have an occupational pension. This pension is in addition to the state pension mentioned above. Members of SPK will accrue an occupational pension and members that qualify will also accrue a contractual pension (AFP). Both schemes are managed by SPK in accordance with public sector regulations.

Voluntary savings or pension schemes

Members can, in addition to the first two pension schemes, secure funds for their retirement through personal savings. One way to do this is to create a private pension scheme that you pay in to voluntarily. Private saving represents the last tier in our pension pyramid.

What will your total pension be?

Your total pension depends on how much you have accumulated in the various levels of the pyramid. If you want to calculate your pension, you can log in and use our pension calculator. Note that we do not include private pension schemes from private employers, or your own savings, in the calculation. We do include the National Insurance Scheme (folketrygden) and the public occupational pensions you may have.