How your pension accrues from 2020 onwards

From 2020 onwards, you accrue retirement pension through contributions to a pension fund. Every year you work in a pensionable position up to the age of 75 will give you pension accrual.

- The pension is calculated independently of retirement pension from the National Insurance Scheme (Nav).

- The payment is lifelong.

- You may have work income alongside your pension – without your pension being reduced.

- You are entitled to retirement pension if you have at least one year of accrual in the pension scheme.

How is the retirement pension calculated?

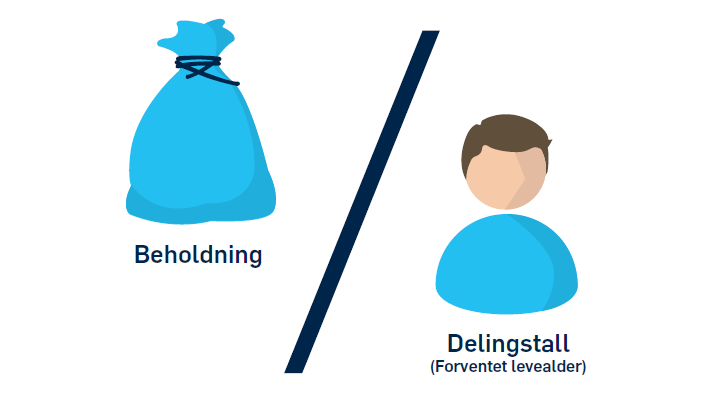

The size of your pension fund and the expected life expectancy for your cohort determine the size of your retirement pension. The pension is calculated based on your accrued fund in the new scheme and the National Insurance Scheme’s divisor (delingstall).

The divisor used in the pension calculation is determined by Statistics Norway. It represents the expected number of remaining years of life for your cohort at the time you start drawing your pension. When you start your pension, we calculate the annual retirement pension by dividing your pension fund by the divisor.

The pension will be paid for life regardless of when you choose to start. However, the annual payment will be higher the longer you wait to withdraw, since the pension is then expected to be paid out over fewer years. You can therefore choose whether you want a lower pension for more years, or a higher pension for fewer years. The longer you wait before starting, the larger your fund will be, and the lower the divisor.

Example

Henrik was born in 1963 and has been assigned a divisor of 20.06 at age 62. If his pension fund is four million kroner when he turns 62, he will receive an annual pension of NOK 199,492 (4,000,000 ÷ 20.06).

Read more about how you accrue retirement pension from 2020.

Withdrawal of retirement pension accrued from 2020

- You can start your retirement pension at any time between the ages of 62 and 75.

- The pension may be drawn in proportions of 20, 40, 50, 60, 80 or 100 per cent. The withdrawal rate can be changed once a year, but you can stop the withdrawal or switch to full pension at any time.

For those with early retirement (previously called “special retirement pension”), special rules apply: You can withdraw retirement pension accrued from 2020 only from the age of 67.

Transitional arrangements

For the cohorts 1963–1970, various supplements have been introduced, including one called the “2011 supplement”, to make the transition from the old to the new rules as fair as possible.

Log in to check your pension

- The pension calculator shows how much pension you have accrued.

- It calculates your annual pension and AFP, including figures from Nav, if keeping your current employment and job.

- See your relevant options for combining work and pension, and how different choices will affect your pension.

- Check that your employment details are registered with the correct salary and percentage of employment.

- Four months before you turn 62, a new option called "Apply for pension" will automatically appear while you are logged in. This option remains visible until you choose to apply.